National Initiative

About the Annual Financial Literacy Week (AFLW).

As a flagship initiative, FLW brings together financial institutions, government partners, and development organizations to deliver coordinated outreach and education across the country. By integrating gender-disaggregated data tracking, the campaign ensures that progress in financial inclusion is measurable, inclusive, and responsive to national priorities. In doing so, FLW supports Ethiopia’s long-term goals of building a stronger, more accessible, and equitable financial system.

Why Gambella Region?

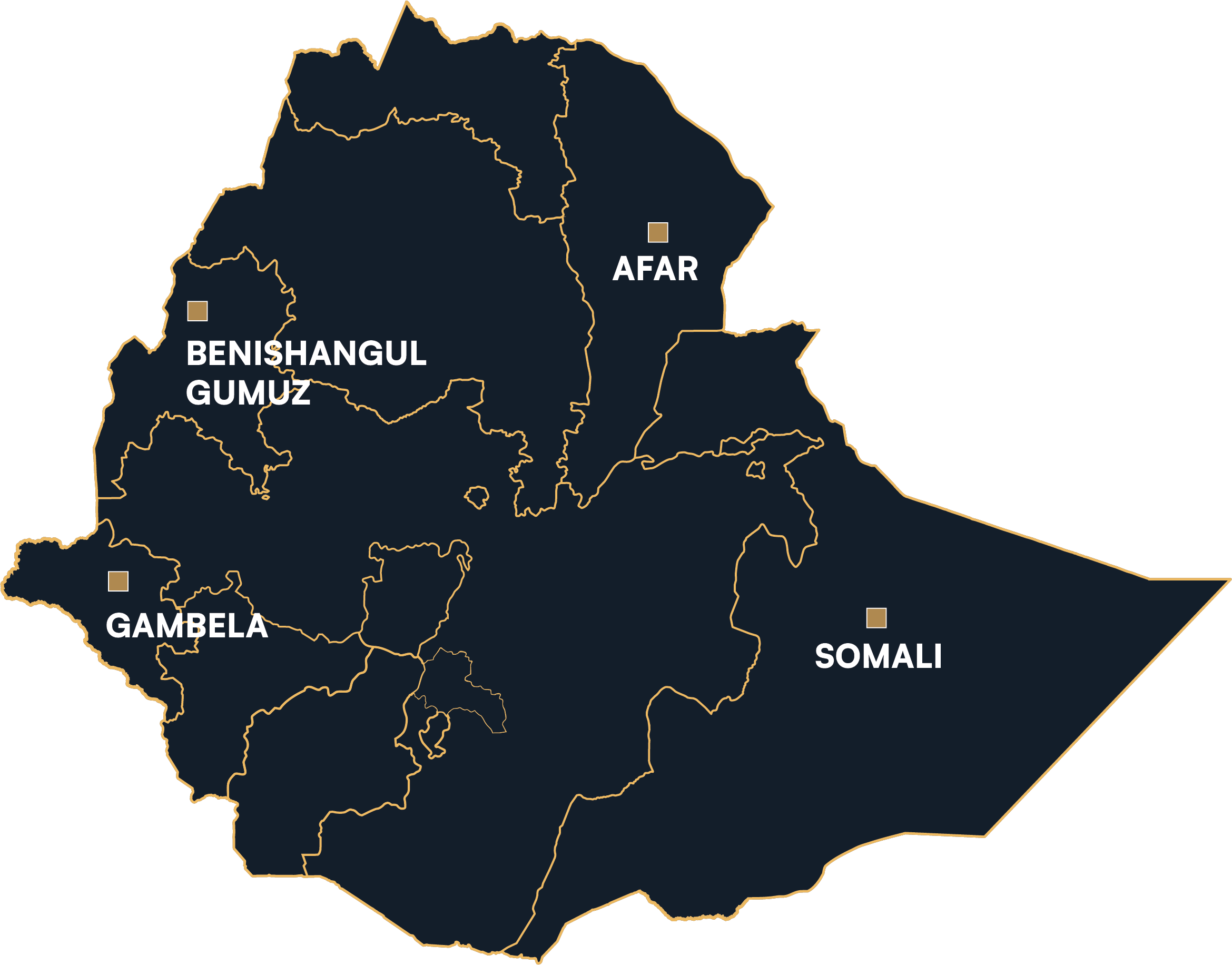

Gambella region was selected as the launch site for Financial Literacy Week because it serves as a vital regional hub linking both urban and rural communities. While the city is experiencing steady economic growth, many residents—especially those in surrounding rural areas with limited financial literacy —still face barriers to accessing financial services and reliable financial information.

Promoting rural financial education is a key priority under the National Financial Education Strategy. This makes Gambella an ideal starting point for expanding financial awareness, strengthening inclusion, and empowering communities to make informed financial decisions.

October 27–31, 2025: Nationwide Campaign – Kickoff Gambella

Goals & Objectives

Gender-Disaggregated Data: Value & Aims

Gender-disaggregated data is vital for understanding how different groups of people access, use, and benefit from financial services. Without such data, financial inclusion initiatives risk overlooking specific barriers faced by certain segments of the population. Collecting and analyzing this information enables policymakers, financial service providers (FSPs), and partners to:

By mainstreaming gender-disaggregated reporting during AFLW 2025, we ensure that participation patterns are visible, measurable, and actionable.

Through systematic collection of gender-disaggregated data during Financial Literacy Week, we aim to:

Ultimately, the goal is not only to count participation, but to ensure that the experiences, exposure, needs, and financial capability of diverse groups shape the future of Ethiopia’s financial sector, aligned with the visions of NFES and NEWFin.